Circularity is one of our eight strategic themes along with: health and safety, climate change, our people, water, tailings management, communities and Indigenous Peoples, and biodiversity and reclamation. Our sustainability strategy has long-term strategic priorities and shorter-term sustainability goals.

Strategic Priorities:

- Be a leader in responsibly providing the metals and minerals needed for the transition to an economy focused on reducing waste and keeping products in use

- Work towards disposing zero industrial waste by 2040

Goals:

- By 2025, establish site-based industrial waste inventories and plans to turn waste into useful and appropriate products. Based on these inventories and plans, set goals for industrial waste reduction.

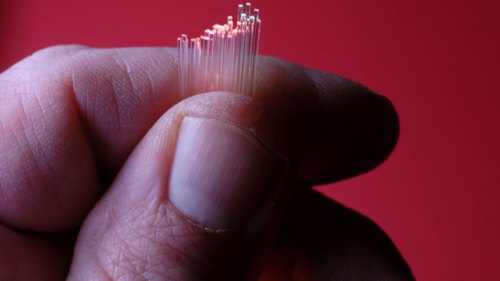

- By 2025, develop and implement a responsible producer program and "product passport" that is traceable through the value chain.

- Be a leader in product stewardship by continuing to implement our Materials Stewardship program and produce secondary metals at our Trail Operations.