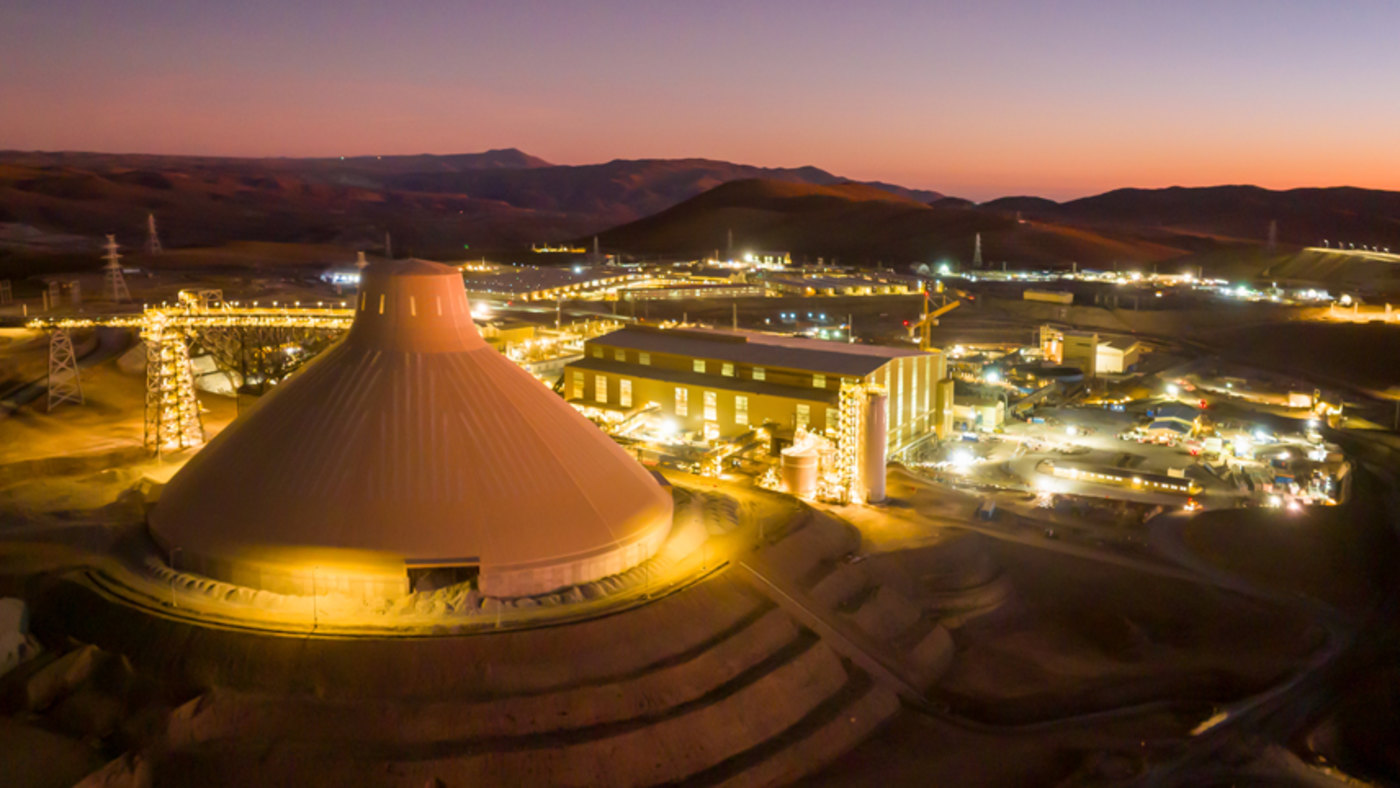

Ramp-up of QB2 continues with strong asset performance

Vancouver, B.C. - Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (Teck) today announced its unaudited third quarter results for 2023.

“We made solid progress on the ramp-up of our flagship QB2 copper project, generating gross profit in the third quarter, and we remain on track to achieve design throughput by year end," said Jonathan Price, CEO. “Positive financial performance was driven by continued strong commodity prices, partially offset by lower steelmaking coal sales due to supply chain disruptions – resulting from the B.C. port strike and wildfires – in the quarter.”

Highlights

- Adjusted profit attributable to shareholders1 of $399 million, or $0.77 per share, in Q3 2023.

- Profit from continuing operations attributable to shareholders of $276 million, or $0.53 per share, in Q3 2023.

- Adjusted EBITDA1 was $1.2 billion in Q3 2023, driven by robust prices for copper and steelmaking coal and higher base metals sales volumes. Profit from continuing operations before taxes was $589 million in Q3 2023.

- Sales volumes in our copper and zinc business units were higher than the same period last year. QB2 continued to ramp-up operations with production of 18,300 tonnes of copper and sales of 14,300 tonnes generating gross profit before depreciation and amortization1 of $19 million in the third quarter.

- The QB2 plant is performing well and we continue to expect to achieve design throughput at QB2 by the end of 2023.

- Steelmaking coal prices remain robust, driven by supply constraints and strong demand, particularly from India and China. Prices rose through the third quarter and into October, with FOB premium spot prices trading at US$343 per tonne as of October 23, 2023. Our high-margin steelmaking coal business unit is well positioned to continue to deliver strong financial performance in the fourth quarter

- We generated cash flows from operations of $736 million, ending the quarter with a cash balance of $1.3 billion.

- Our liquidity as at October 23, 2023 is $7.0 billion, including $1.5 billion of cash.

- We continue to advance our copper growth portfolio. In the third quarter, we completed the feasibility study for our HVC 2040 project and submitted the Project Environmental Assessment to the Environmental Assessment Office of British Columbia in October 2023.

Note:

1. This is a Non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information.

Financial Summary Q3 2023

| Financial Metrics (CAD$ in millions, except per share data) |

Q3 2023

|

Q3 2022 |

||||||

|

Revenue |

$3,599 |

$4,260 |

||||||

|

Gross profit |

$831 |

$1,797 |

||||||

|

Gross profit before depreciation and amortization1 |

$1,360 |

$2,255 |

||||||

|

Profit from continuing operations before taxes |

$589 |

$1,081 |

||||||

|

Adjusted EBITDA1 |

$1,213 |

$1,901 |

||||||

|

Profit from continuing operations attributable to shareholders |

$276 |

$741 |

||||||

|

Adjusted profit attributable to shareholders1 |

$399 |

$923 |

||||||

|

Basic earnings per share from continuing operations |

$0.53 |

$1.42 |

||||||

|

Diluted earnings per share from continuing operations |

$0.52 |

$1.40 |

||||||

|

Adjusted basic earnings per share1 |

$0.77 |

$1.77 |

||||||

|

Adjusted diluted earnings per share1 |

$0.76 |

$1.74 |

||||||

Note:

1. This is a Non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information.

Key Updates

Executing on our copper growth strategy – QB2 a long-life, low-cost operation with major expansion potential

- QB2 generated gross profit before depreciation and amortization1 of $19 million in the third quarter.

- Line 2 fully commissioned at the end of September, benefiting from the learnings from Line 1 commissioning with a faster, more effective ramp-up schedule.

- At the end of the third quarter the plant has been operating consistently at 70% of design capacity. We expect to be operating at design throughput and recovery rates by year end, although we expect to be at the lower end of our 2023 annual production guidance for QB2.

- Construction completion of the molybdenum plant is now expected by the end of the fourth quarter of 2023 and the port offshore facilities completion is expected in the first quarter of 2024. Existing shipping arrangements are expected to provide adequate capacity for shipping product though the first quarter of 2024.

- Delays in construction of the molybdenum plant and port offshore facilities, slower than planned demobilization progress and contract claims risk have put pressure on our capital cost guidance. As a result, we have updated our capital cost guidance for QB2 to US$8.6 to US$8.8 billion from our previously disclosed guidance of US$8.0 to US$8.2 billion. Significant efforts are ongoing to mitigate the risks and cost pressures.

Note:

1. This is a Non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information.

Safety and Sustainability Leadership

- Our High Potential Incident Frequency remained low at a rate of 0.13 in the third quarter.

- We announced an agreement with Norden that is expected to reduce CO2 emissions in our steelmaking coal supply chain for Teck shipments handled by Norden.

Guidance

- Our guidance is outlined in summary below and our usual guidance tables, including three-year production guidance, can be found on pages 28 — 32 of Teck’s third quarter results for 2023 at the link below.

- Our previously disclosed guidance has been updated for changes to our capital cost guidance for QB2, as outlined above, 2023 annual copper, molybdenum and steelmaking coal production guidance, noted below, and 2023 capitalized stripping guidance for our copper business unit.

- Our 2023 annual copper production guidance has decreased to 320,000 to 365,000 tonnes from 330,000 to 375,000 tonnes, driven by a localized geotechnical event at Highland Valley Copper that occurred in August. We do not expect this geotechnical event to impact our annual production guidance beyond 2023. Our 2023 annual copper production guidance for QB2 is unchanged from our previously disclosed guidance of 80,000 to 100,000 tonnes, although we expect to be at the lower end of this range.

- Our 2023 annual molybdenum production guidance has decreased to 3.0 to 3.8 million pounds from 4.5 to 6.8 million pounds due to the delay in the construction of the QB2 molybdenum plant, as outlined above.

- Due to plant challenges this year, we have reduced our 2023 annual steelmaking coal production guidance to 23.0 to 23.5 million tonnes from 24.0 to 26.0 million tonnes. We implemented a plant improvement initiative in the second and third quarters. Combined with the completed major maintenance outages, we are seeing improved plant performance in the fourth quarter and we are well positioned for the remainder of the year.

| 2023 Guidance – Summary | Current |

|

Production Guidance |

|

|

Copper (000's tonnes) |

320 - 365 |

|

Zinc (000's tonnes) |

645 - 685 |

|

Refined zinc (000's tonnes) |

270 - 290 |

|

Steelmaking coal (million tonnes) |

23.0 - 23.5 |

|

Sales Guidance – Q3 2023 |

|

|

Red Dog zinc in concentrate sales (000's tonnes) |

130 - 150 |

|

Steelmaking coal sales (million tonnes) |

5.8 - 6.2 |

|

Unit Cost Guidance |

|

|

Copper net cash unit costs (US$/lb.)1 2 |

1.60 - 1.80 |

|

Zinc net cash unit costs (US$/lb.)1 |

0.50 - 0.60 |

|

Steelmaking coal adjusted site cash cost of sales (CAD$/tonne)1 |

88 - 96 |

|

Steelmaking coal transportation costs (CAD$/tonne)1 |

45 - 48 |

Note:

1. This is a Non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information.

2. Excludes Quebrada Blanca

Click here to view Teck’s full second quarter results for 2023.

WEBCAST

Teck will host an Investor Conference Call to discuss its Q3/2023 financial results at 8:00 AM Eastern time, 5:00 AM Pacific time, on October 24, 2023. A live audio webcast of the conference call, together with supporting presentation slides, will be available at our website at www.teck.com. The webcast will be archived at www.teck.com.

Reference:

Fraser Phillips, Senior Vice President, Investor Relations and Strategic Analysis: 604.699.4621

Chris Stannell, Public Relations Manager: 604.699.4368

USE OF NON-GAAP FINANCIAL MEASURES AND RATIOS

Our annual financial results are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. Our interim financial results are prepared in accordance with IAS 34, Interim Financial Reporting (IAS 34). This document refers to a number of non-GAAP financial measures and non-GAAP ratios which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS or by Generally Accepted Accounting Principles (GAAP) in the United States.

The non-GAAP financial measures and non-GAAP ratios described below do not have standardized meanings under IFRS, may differ from those used by other issuers, and may not be comparable to similar financial measures and ratios reported by other issuers. These financial measures and ratios have been derived from our financial statements and applied on a consistent basis as appropriate. We disclose these financial measures and ratios because we believe they assist readers in understanding the results of our operations and financial position and provide further information about our financial results to investors. These measures should not be considered in isolation or used in substitute for other measures of performance prepared in accordance with IFRS.

Adjusted profit attributable to shareholders – For adjusted profit attributable to shareholders, we adjust profit (loss) attributable to shareholders as reported to remove the after-tax effect of certain types of transactions that reflect measurement changes on our balance sheet or are not indicative of our normal operating activities.

EBITDA – EBITDA is profit before net finance expense, provision for income taxes, and depreciation and amortization.

Adjusted EBITDA – Adjusted EBITDA is EBITDA before the pre-tax effect of the adjustments that we make to adjusted profit attributable to shareholders as described above.

Adjusted profit attributable to shareholders, EBITDA, and Adjusted EBITDA highlight items and allow us and readers to analyze the rest of our results more clearly. We believe that disclosing these measures assists readers in understanding the ongoing cash generating potential of our business in order to provide liquidity to fund working capital needs, service outstanding debt, fund future capital expenditures and investment opportunities, and pay dividends.

Adjusted basic earnings per share – Adjusted basic earnings per share is adjusted profit attributable to shareholders divided by average number of shares outstanding in the period.

Adjusted diluted earnings per share – Adjusted diluted earnings per share is adjusted profit attributable to shareholders divided by average number of fully diluted shares in a period.

Gross profit before depreciation and amortization – Gross profit before depreciation and amortization is gross profit with depreciation and amortization expense added back. We believe this measure assists us and readers to assess our ability to generate cash flow from our business units or operations.

Unit costs – Unit costs for our steelmaking coal operations are total cost of goods sold, divided by tonnes sold in the period, excluding depreciation and amortization charges. We include this information as it is frequently requested by investors and investment analysts who use it to assess our cost structure and margins and compare it to similar information provided by many companies in the industry.

Adjusted site cash cost of sales – Adjusted site cash cost of sales for our steelmaking coal operations is defined as the cost of the product as it leaves the mine excluding depreciation and amortization charges, out-bound transportation costs and any one-time collective agreement charges and inventory write-down provisions.

Total cash unit costs – Total cash unit costs for our copper and zinc operations includes adjusted cash costs of sales, as described below, plus the smelter and refining charges added back in determining adjusted revenue. This presentation allows a comparison of total cash unit costs, including smelter charges, to the underlying price of copper or zinc in order to assess the margin for the mine on a per unit basis.

Net cash unit costs – Net cash unit costs of principal product, after deducting co-product and by-product margins, are also a common industry measure. By deducting the co- and by-product margin per unit of the principal product, the margin for the mine on a per unit basis may be presented in a single metric for comparison to other operations.

Adjusted cash cost of sales – Adjusted cash cost of sales for our copper and zinc operations is defined as the cost of the product delivered to the port of shipment, excluding depreciation and amortization charges, any one-time collective agreement charges or inventory write-down provisions and by-product cost of sales. It is common practice in the industry to exclude depreciation and amortization as these costs are non-cash and discounted cash flow valuation models used in the industry substitute expectations of future capital spending for these amounts.

Adjusted site cash cost of sales per tonne – Adjusted site cash cost of sales per tonne is a non-GAAP ratio comprised of adjusted site cash cost of sales divided by tonnes sold. There is no similar financial measure in our consolidated financial statements with which to compare.

Profit Attributable to Shareholders and Adjusted Profit Attributable to Shareholders

|

|

Three months ended September 30, |

Nine Months ended September 30, |

||||

|

(CAD$ in millions) |

2023 |

2022 |

2023 |

2022 |

||

|

Profit from continuing operations attributable to shareholders |

$276 |

$741 |

$1,952 |

$3,842 |

||

|

Add (deduct) on an after-tax basis 1: |

|

|

|

|

||

|

Asset impairment |

- |

952 |

- |

952 |

||

|

Loss on debt purchase |

- |

- |

- |

46 |

||

|

QB2 variable consideration to IMSA and ENAMI |

(45) |

12 |

26 |

108 |

||

|

Environmental costs |

(25) |

7 |

(9) |

(104) |

||

|

Inventory write-downs |

4 |

15 |

4 |

38 |

||

|

Share-based compensation |

21 |

26 |

81 |

114 |

||

|

Commodity derivatives |

10 |

(4) |

29 |

(7) |

||

|

Loss (gain) on disposal or contribution of assets |

6 |

1 |

(186) |

1 |

||

|

Elkview business interruption claim |

(1) |

- |

(150) |

- |

||

|

Chilean tax reform |

69 |

- |

69 |

- |

||

|

Loss from discontinued operations 2 |

- |

(936) |

- |

(791) |

||

|

Other |

84 |

109 |

156 |

116 |

||

|

Adjusted profit attributable to shareholders |

$399 |

$923 |

$1,972 |

$4,315 |

||

|

Basic earnings per share from continuing operations |

$0.53 |

$1.42 |

$3.77 |

$7.23 |

||

|

Diluted earnings per share from continuing operations |

$0.52 |

$1.40 |

$3.72 |

$7.10 |

||

|

Adjusted basic earnings per share |

$0.77 |

$1.77 |

$3.81 |

$8.12 |

||

|

Adjusted diluted earnings per share |

$0.76 |

$1.74 |

$3.76 |

$7.98 |

||

Notes:

1. Adjustments for the three and nine months ended September 30, 2022 are as previously reported.

2. Adjustment required to remove the effect of discontinued operations for the three and nine months ended September 30, 2022.

Reconciliation of Basic Earnings per share to Adjusted Basic Earnings per share

|

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

(Per share amounts) |

2023 |

2022 |

2023 |

2022 |

||

|

Basic earnings per share from continuing operations |

$0.53 |

$1.42 |

$3.77 |

$7.23 |

||

|

Add (deduct) 1: |

|

|

|

|

||

|

Asset impairment |

- |

1.82 |

- |

1.79 |

||

|

Loss on debt purchase |

- |

- |

- |

0.09 |

||

|

QB2 variable consideration to IMSA and ENAMI |

(0.09) |

0.02 |

0.05 |

0.20 |

||

|

Environmental Costs |

(0.05) |

0.01 |

(0.02) |

(0.20) |

||

|

Inventory write-downs |

0.01 |

0.03 |

0.01 |

0.07 |

||

|

Share-based compensation |

0.05 |

0.05 |

0.16 |

0.21 |

||

|

Commodity derivatives |

0.02 |

(0.01) |

0.06 |

(0.01) |

||

|

Loss (gain) on disposal or contribution of assets |

0.01 |

- |

(0.36) |

- |

||

|

Elkview business interruption claim |

- |

- |

(0.29) |

- |

||

|

Chilean tax reform |

0.13 |

- |

0.13 |

- |

||

|

Loss from discontinued operations 2 |

- |

(1.79) |

- |

(1.49) |

||

|

Other |

0.16 |

0.22 |

0.3 |

0.23 |

||

|

Adjusted basic earnings per share |

$0.77 |

$1.77 |

$3.81 |

$8.12 |

||

Notes:

1. Adjustments for the three and nine months ended September 30, 2022 are as previously reported.

2. Adjustment required to remove the effect of discontinued operations for the three and nine months ended September 30, 2022.

Reconciliation of Diluted Earnings per share to Adjusted Diluted Earnings per share

|

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

(Per share amounts) |

2023 |

2022 |

2023 |

2022 |

||

|

Diluted earning per share from continuing operations |

$0.52 |

$1.40 |

$3.72 |

$7.10 |

||

|

Add (deduct) 1: |

|

|

|

|

||

|

Asset impairment |

- |

1.80 |

- |

1.76 |

||

|

Loss on debt purchase |

- |

- |

- |

0.09 |

||

|

QB2 variable consideration to IMSA and ENAMI |

(0.09) |

0.02 |

0.05 |

0.20 |

||

|

Environmental costs |

(0.05) |

0.01 |

(0.02) |

(0.19) |

||

|

Inventory write-downs |

0.01 |

0.03 |

0.01 |

0.07 |

||

|

Share-based compensation |

0.05 |

0.05 |

0.15 |

0.21 |

||

|

Commodity derivatives |

0.02 |

(0.01) |

0.06 |

(0.01) |

||

|

Loss (gain) on disposal or contribution of assets |

0.01 |

- |

(0.35) |

- |

||

|

Elkview business interruption claim |

- |

- |

(0.29) |

- |

||

|

Chilean tax reform |

0.13 |

- |

0.13 |

- |

||

|

Loss from discontinued operations 2 |

- |

(1.77) |

- |

(1.46) |

||

|

Other |

0.16 |

0.21 |

0.30 |

0.21 |

||

|

Adjusted diluted earnings per share |

$0.76 |

$1.74 |

$3.76 |

$7.98 |

||

Notes:

1. Adjustments for the three and nine months ended September 30, 2022 are as previously reported.

2. Adjustment required to remove the effect of discontinued operations for the three and nine months ended September 30, 2022.

Reconciliation of EBITDA and Adjusted EBITDA

|

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

(CAD$ in millions) |

2023 |

2022 |

2023 |

2022 |

||

|

Profit from continuing operations before taxes |

$589 |

$1,081 |

$3,250 |

$5,971 |

||

|

Finance expense net of finance income |

39 |

44 |

108 |

127 |

||

|

Depreciation and amortization |

529 |

458 |

1,383 |

1,290 |

||

|

EBITDA |

1,157 |

1,583 |

4,741 |

7,388 |

||

|

Add (deduct) 1: |

|

|

|

|

||

|

Asset impairment |

- |

1,234 |

- |

1,234 |

||

|

Loss on debt purchase |

- |

- |

- |

63 |

||

|

QB2 variable consideration to IMSA and ENAMI |

(75) |

40 |

41 |

201 |

||

|

Environmental Costs |

(35) |

9 |

(14) |

(144) |

||

|

Inventory write-downs |

6 |

21 |

6 |

53 |

||

|

Share-based compensation |

26 |

33 |

104 |

148 |

||

|

Commodity derivatives |

15 |

(7) |

39 |

(11) |

||

|

Loss (gain) on disposal or contribution of assets |

9 |

1 |

(255) |

1 |

||

|

Elkview business interruption claim |

(2) |

- |

(221) |

- |

||

|

EBITDA from discontinued operations 2 |

- |

(1,115) |

- |

(811) |

||

|

Other |

112 |

102 |

223 |

113 |

||

|

Adjusted EBITDA |

$1,213 |

$1,901 |

$4,664 |

$8,235 |

||

Notes:

1. Adjustments for the three and nine months ended September 30, 2022 are as previously reported.

2. Adjustment required to remove the effect of discontinued operations for the three and nine months ended September 30, 2022.

Reconciliation of Gross Profit Before Depreciation and Amortization

|

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

(CAD$ in millions) |

2023 |

2022 |

2023 |

2022 |

||

|

Gross Profit |

$831 |

$1,797 |

$3,907 |

$7,417 |

||

|

Depreciation and amortization |

529 |

458 |

1,383 |

1,290 |

||

|

Gross profit before depreciation and amortization |

$1,360 |

$2,255 |

$5,290 |

$8,707 |

||

|

Reported as: |

|

|

|

|

||

|

Copper |

|

|

|

|

||

|

Highland Valley Copper |

$57 |

$140 |

$290 |

$603 |

||

|

Antamina |

215 |

245 |

671 |

801 |

||

|

Carmen de Andacollo |

1 |

(18) |

10 |

58 |

||

|

Quebrada Blanca |

19 |

(9) |

18 |

11 |

||

|

Other |

1 |

- |

(5) |

- |

||

|

|

293 |

358 |

984 |

1,473 |

||

|

Zinc |

|

|

|

|

||

|

Trail Operations |

22 |

(14) |

91 |

32 |

||

|

Red Dog |

220 |

424 |

470 |

881 |

||

|

Other |

(2) |

6 |

(4) |

2 |

||

|

|

240 |

416 |

557 |

915 |

||

|

Steelmaking coal |

827 |

1,481 |

3,749 |

6,319 |

||

|

Gross profit before depreciation and amortization |

$1,360 |

$2,255 |

$5,290 |

$8,707 |

||

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to as forward-looking statements). These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “should”, “believe” and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These statements speak only as of the date of this news release.

These forward-looking statements include, but are not limited to, statements concerning: our focus and strategy; anticipated global and regional supply, demand and market outlook for our commodities; expectation that QB2 will be a long-life, low-cost operation with major expansion potential; QB2 capital cost guidance and expectations for development capital spending and capitalized ramp-up commissioning costs; expectation that cost pressures at QB2 can be mitigated; expectation that QB2 will continue to ramp-up and achieve design throughput by the end of 2023; our expectation with respect to completion of the port and molybdenum plant at QB2; expectation of reduced CO2 emissions in our steelmaking coal supply chain for shipments handled by Norden; expectations with respect to improved plant performance in the fourth quarter; expectations with respect to timing and receipt of approval of the MEIA at Antamina; expectations with respect to execution of our copper growth strategy; expectations regarding our Quebrada Blanca Mill Expansion project, including timing for permitting and completion of the feasibility study; expectations regarding the HVC 2040 project, including timing for feasibility study completion; expectations regarding the San Nicolás project, including timing for submission of the MIA-R permit application and completion of the feasibility study; expectations regarding the Zafranal project, including timing for commencement of detailed engineering; expectations regarding the NewRange joint venture, including our ability to advance permitting and the timing for completion of the NorthMet feasibility study; expectations regarding the Galore Creek project, including advancement of the prefeasibility study; expectations with respect to replacement of the KIVCET boiler at Trail Operations; expectations for stabilization and reduction of the selenium trend in the Elk Valley; expectations for total water treatment capacity; projected spending, including capital and operating costs, from 2023-2024 on water treatment, water management and incremental measures associated with the Direction; timing of advancement and completion of key water treatment projects; our expectation that we will increase our water treatment capacity to 150 million litres per day by the end of 2026; expectations regarding engagement with U.S. regulators on water quality standards; expectations regarding finance expenses in 2024 and general and administration expenses through year end 2023; expectations with respect to the impacts of the Chilean Mining Royalty bill; expectations regarding timing and amount of income tax payments; liquidity and availability of borrowings under our credit facilities; our ability to obtain additional credit for posting security for reclamation at our sites; all guidance appearing in this document including but not limited to the production, sales, cost, unit cost, capital expenditure, capitalized stripping, and other guidance under the heading “Guidance” and as discussed elsewhere in the various business unit sections; our expectations regarding inflationary pressures and increased key input costs, including profit based compensation and royalties; and expectations regarding the adoption of new accounting standards and the impact of new accounting developments.

These statements are based on a number of assumptions, including, but not limited to, assumptions disclosed elsewhere in this document and assumptions regarding general business and economic conditions, interest rates, commodity and power prices; acts of foreign or domestic governments and the outcome of legal proceedings; the supply and demand for, deliveries of, and the level and volatility of prices of copper, zinc and steelmaking coal and our other metals and minerals, as well as steel, crude oil, natural gas and other petroleum products; the timing of the receipt of permits and other regulatory and governmental approvals for our development projects and other operations, including mine extensions; positive results from the studies on our expansion and development projects; our ability to secure adequate transportation, including rail and port services, for our products; our costs of production and our production and productivity levels, as well as those of our competitors; continuing availability of water and power resources for our operations; changes in credit market conditions and conditions in financial markets generally; the availability of funding to refinance our borrowings as they become due or to finance our development projects on reasonable terms; availability of letters of credit and other forms of financial assurance acceptable to regulators for reclamation and other bonding requirements; our ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; the availability of qualified employees and contractors for our operations, including our new developments and our ability to attract and retain skilled employees; the satisfactory negotiation of collective agreements with unionized employees; the impact of changes in Canadian-U.S. dollar, Canadian dollar-Chilean Peso and other foreign exchange rates on our costs and results; engineering and construction timetables and capital costs for our development and expansion projects; our ability to develop technology and obtain the benefits of technology for our operations and development projects; closure costs; environmental compliance costs; market competition; the accuracy of our mineral reserve and resource estimates (including with respect to size, grade and recoverability) and the geological, operational and price assumptions on which these are based; tax benefits and tax rates; the outcome of our coal price and volume negotiations with customers; the outcome of our copper, zinc and lead concentrate treatment and refining charge negotiations with customers; the resolution of environmental and other proceedings or disputes; our ability to obtain, comply with and renew permits, licenses and leases in a timely manner; and our ongoing relations with our employees and with our business and joint venture partners.

In addition, assumptions regarding the Elk Valley Water Quality Plan include assumptions that additional treatment will be effective at scale, and that the technology and facilities operate as expected, as well as additional assumptions discussed under the heading “Elk Valley Water Management Update.” Assumptions regarding QB2 include current project assumptions and assumptions regarding the final feasibility study, estimates of future construction capital at QB2 are based on a CLP/USD rate range of 800 — 850, as well as there being no further unexpected material and negative impact to the various contractors, suppliers and subcontractors for the QB2 project that would impair their ability to provide goods and services as anticipated during commissioning and ramp-up activities. Statements regarding the availability of our credit facilities are based on assumptions that we will be able to satisfy the conditions for borrowing at the time of a borrowing request and that the facilities are not otherwise terminated or accelerated due to an event of default. Assumptions regarding the costs and benefits of our projects include assumptions that the relevant project is constructed, commissioned and operated in accordance with current expectations. Expectations regarding our operations are based on numerous assumptions regarding the operations. Our Guidance tables include disclosure and footnotes with further assumptions relating to our guidance, and assumptions for certain other forward-looking statements accompany those statements within the document. Statements concerning future production costs or volumes are based on numerous assumptions regarding operating matters and on assumptions that demand for products develops as anticipated, that customers and other counterparties perform their contractual obligations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labour disturbances, interruption in transportation or utilities, or adverse weather conditions, and that there are no material unanticipated variations in the cost of energy or supplies. Statements regarding anticipated steelmaking coal sales volumes and average steelmaking coal prices depend on timely arrival of vessels and performance of our steelmaking coal-loading facilities, as well as the level of spot pricing sales. The foregoing list of assumptions is not exhaustive. Events or circumstances could cause actual results to vary materially.

Factors that may cause actual results to vary materially include, but are not limited to, changes in commodity and power prices; changes in market demand for our products; changes in interest and currency exchange rates; acts of governments and the outcome of legal proceedings; inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources); operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of labour, materials and equipment, government action or delays in the receipt of government approvals, changes in royalty or tax rates, industrial disturbances or other job action, adverse weather conditions and unanticipated events related to health, safety and environmental matters); union labour disputes; impact of COVID-19 and related mitigation protocols; political risk; social unrest; failure of customers or counterparties (including logistics suppliers) to perform their contractual obligations; changes in our credit ratings; unanticipated increases in costs to construct our development projects; difficulty in obtaining permits; inability to address concerns regarding permits or environmental impact assessments; and changes or further deterioration in general economic conditions. The amount and timing of capital expenditures is depending upon, among other matters, being able to secure permits, equipment, supplies, materials and labour on a timely basis and at expected costs. Certain operations and projects are not controlled by us; schedules and costs may be adjusted by our partners, and timing of spending and operation of the operation or project is not in our control. Certain of our other operations and projects are operated through joint arrangements where we may not have control over all decisions, which may cause outcomes to differ from current expectations. Current and new technologies relating to our Elk Valley water treatment efforts may not perform as anticipated, and ongoing monitoring may reveal unexpected environmental conditions requiring additional remedial measures. QB2 costs, commissioning and commercial production is dependent on, among other matters, our continued ability to advance commissioning and ramp-up as currently anticipated and successfully manage through any remaining impacts of COVID-19, including but not limited to absenteeism and lowered productivity. QB2 costs may also be affected by claims and other proceedings that might be brought against us relating to costs and impacts of the COVID-19 pandemic. Production at our Red Dog Operations may also be impacted by water levels at site. Sales to China may be impacted by general and specific port restrictions, Chinese regulation and policies, and normal production and operating risks. The forward-looking statements in this news release and actual results will also be impacted by the continuing effects of COVID-19 and related matters, particularly if there is a further resurgence of the virus.

We assume no obligation to update forward-looking statements except as required under securities laws. Further information concerning risks, assumptions and uncertainties associated with these forward-looking statements and our business can be found in our Annual Information Form for the year ended December 31, 2022, filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov) under cover of Form 40-F, as well as subsequent filings that can also be found under our profile.

Scientific and technical information in this quarterly report regarding our coal properties, which for this purpose does not include the discussion under “Elk Valley Water Management Update” was reviewed, approved and verified by Jo-Anna Singleton, P.Geo. and Cameron Feltin, P.Eng., each an employee of Teck Coal Limited and a Qualified Person as defined under National Instrument 43-101. Scientific and technical information in this quarterly report regarding our other properties was reviewed, approved and verified by Rodrigo Alves Marinho, P.Geo., an employee of Teck and a Qualified Person as defined under National Instrument 43-101.

23-59-TR