Fourth consecutive record quarter

Vancouver, B.C. – Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (“Teck”) today announced its unaudited second quarter results for 2022.

“This marks Teck’s fourth consecutive quarter of record-setting EBITDA and profitability, driven by strong commodity prices in the quarter, which enabled us to complete $572 million in share buybacks and pay down a further US$650 million in outstanding debt,” said Don Lindsay, President and CEO. “Our solid operational performance, strong balance sheet and $8.4 billion in liquidity all put Teck on a very strong footing as we manage through inflationary pressures and a slowdown in the global economy.”

Highlights

-

Adjusted profit attributable to shareholders1 was a quarterly record $1.8 billion or $3.30 per share in Q2 2022 and more than five times higher than the same period last year.

-

Profit attributable to shareholders was a quarterly record of $1.7 billion or $3.12 per share in Q2 2022.

-

Adjusted EBITDA1 was a quarterly record $3.3 billion in Q2 2022 and more than three times higher than the same period last year. Profit before tax was a record $2.7 billion in Q2 2022.

-

We generated cash flow from operations of $2.9 billion in Q2 2022, purchased US$650 million of our outstanding term notes and ended the quarter with a cash balance of $2.7 billion. As at July 26, 2022, our liquidity is $8.4 billion, including $3.3 billion of cash.

-

In Q2 2022, we completed $572 million in Class B subordinate voting share buybacks, including US$436 million ($562 million) of the US$500 million previously announced in April and the remaining $10 million of the $100 million announced in Q1. We also returned $67 million to shareholders through dividends in the second quarter. On July 26, 2022, we declared a $0.125 per share dividend and authorized up to a US$500 million share buyback, in addition to the previously announced buybacks noted above. Additional buybacks will be considered regularly in the context of market conditions at the time.

-

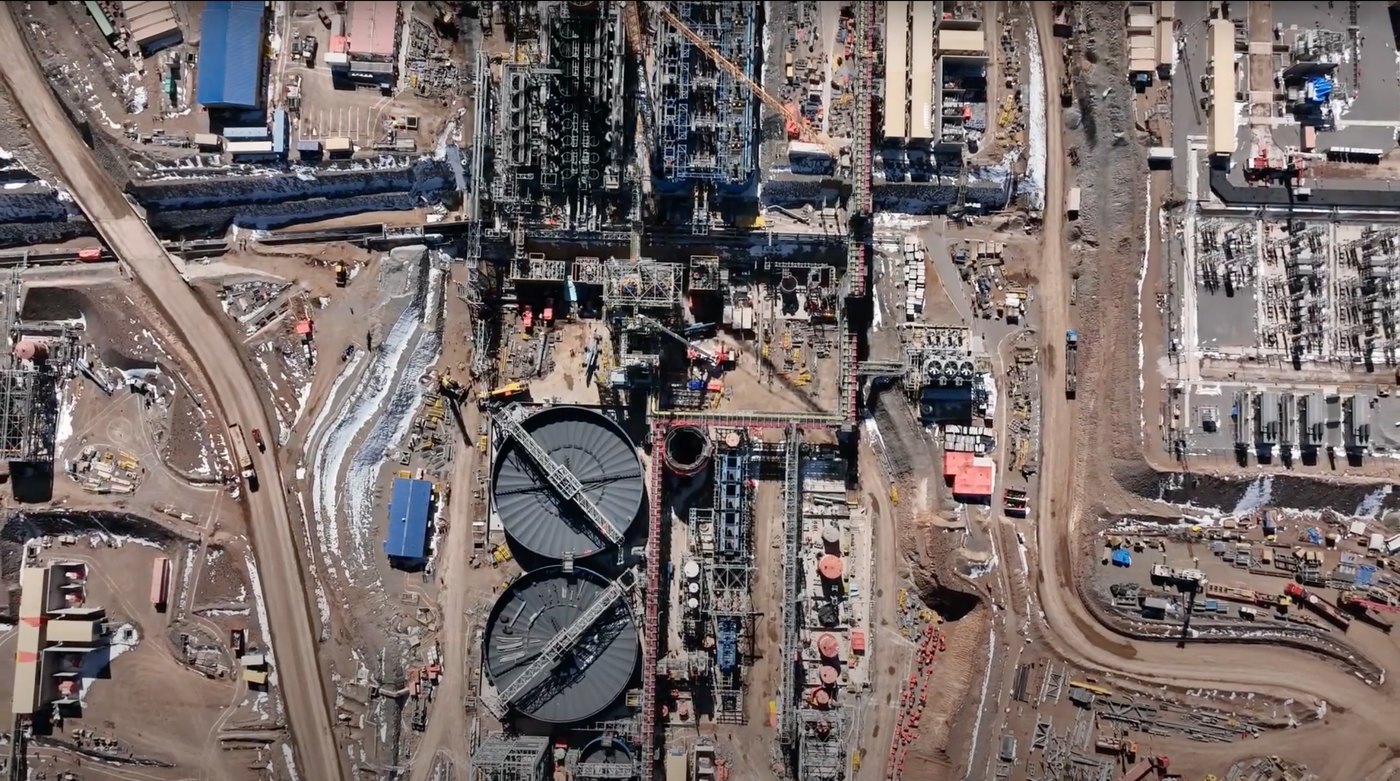

At QB2, we now have approximately 13,000 workers on the project and have seen steady progress through the quarter with our focus on system completion and handover, as we continue to target first copper late this year. Our capital cost estimate, before COVID-19 impacts, remains unchanged from our Q3 2021 guidance of US$5.26 billion with up to 5% additional contingency. Our capital cost guidance for COVID-19 impacts has increased to US$1.4—$1.5 billion due to the impact of inflation on labour costs, the ultimate impacts of the Omicron wave experienced in Q1 and ongoing inefficiencies including as a result of COVID-19 related absenteeism, which continues to run approximately 10%. We continue to target first copper from Line 1 in the later part of this year, however, if COVID-19 absenteeism and related vendor specialty craft availability continue into the fourth quarter, this may be delayed into January 2023.

-

Our copper business unit gross profit increased 5% from a year ago, supported by an average realized copper price of US$4.28 per pound and copper sales volumes of 75,800 tonnes.

-

Our zinc business unit gross profit more than doubled from a year ago, supported by an average realized zinc price of US$1.79 per pound and quarterly zinc in concentrate sales volumes of 55,800 tonnes. In July, we reached a five-year collective agreement at our Trail Operations.

-

Record high realized steelmaking coal prices of US$453 per tonne drove a $2.3 billion gross profit increase in our steelmaking coal business unit, compared to the same period last year. Strong supply chain performance through our upgraded Neptune port enabled the rapid reduction of record-high inventory levels from early 2022, allowing us to capitalize on high steelmaking coal prices in the quarter. As the cornerstone of our supply chain transformation, our upgraded Neptune port supported improved supply chain reliability and resilience, avoiding the potential loss in revenue in excess of $1 billion since July 2021.

-

While our underlying key mining drivers remain relatively stable, like others in the industry, we continue to face inflationary cost pressures. Inflationary pressures have increased our operating costs by 14% compared to the same period last year, of which approximately half relates to an increase in diesel costs.

-

We set a goal to be a nature positive company by 2030, including through conserving or rehabilitating at least three hectares of land for every one hectare of land affected by our mining operations.

1. This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information.

Financial Summary Q2 2022

| Financial Metrics (CAD$ in millions, except per share data) |

Q2 2022

|

Q2 2021 |

||||||

|

Revenue |

$5,787 |

$2,558 |

||||||

|

Gross profit |

$3,288 |

$689 |

||||||

|

Gross profit before depreciation and amortization1 |

$3,740 |

$1,059 |

||||||

|

Profit before taxes |

$2,663 |

$469 |

||||||

|

Adjusted EBITDA1 |

$3,290 |

$989 |

||||||

|

Profit attributable to shareholders |

$1,675 |

$260 |

||||||

|

Adjusted profit attributable to shareholders1 |

$1,772 |

$339 |

||||||

|

Basic earnings per share |

$3.12 |

$0.49 |

||||||

|

Diluted earnings per share |

$3.07 |

$0.48 |

||||||

|

Adjusted basic earnings per share1 |

$3.30 |

$0.64 |

||||||

|

Adjusted diluted earnings per share1 |

$3.25 |

$0.63 |

||||||

Note:

1. This is a Non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information.

Key Updates

Executing on our copper growth strategy – QB2 a long-life, low-cost operation with major expansion potential

-

We now have approximately 13,000 workers on the project, despite the impact COVID-19 continues to have on workforce absenteeism;

-

Focus continues to be on system completion and handover;

-

We have completed construction of the 220kV Transmission System;

-

We are continuing sequential energization of electrical substations;

-

We have commenced pumping of seawater into the pretreatment area of the desalination plant for commissioning;

-

We have completed the starter dam to its design elevation;

-

Our capital cost estimate, before COVID-19 impacts, remains unchanged from our Q3 2021 guidance of US$5.26 billion with up to 5% additional contingency;

-

Our capital cost guidance for COVID-19 impacts has increased to US$1.4—$1.5 billion due to the impact of inflation on labour costs, the ultimate impacts of the Omicron wave experienced in Q1 and ongoing inefficiencies including as a result of COVID-19 absenteeism, which continues to run approximately 10%; and

-

We continue to target first copper from Line 1 in the later part of this year, however, if COVID-19 absenteeism and related vendor specialty craft availability continue into the fourth quarter, this may be delayed into January 2023.

-

Click here for a photo gallery and click here for a video of construction progress on QB2.

Safety and sustainability leadership

-

Our High Potential Incident Frequency remained low at a rate of 0.10 in the first half of 2022.

-

We announced a Carbon Capture Utilization and Storage pilot project at our Trail Operations, which supports Teck's Net Zero Climate Change Strategy including our goal to reduce the carbon intensity of our operations by 33% by 2030 and achieve net-zero emissions by 2050.

-

We were named to the Best 50 Corporate Citizens in Canada ranking as one of the top 50 companies in Canada for corporate citizenship for the 16th consecutive year.

Guidance

-

We have updated our 2022 annual guidance for unit costs across our business units, as well as steelmaking coal production volumes, steelmaking coal capital expenditures, and COVID-19 capital cost guidance for QB2, as outlined in summary below. Our usual guidance tables, including three-year production guidance, can be found on pages 31—35.

-

Like others in the industry, we continue to face inflationary cost pressures, which have increased our operating costs by 14% compared to the same period last year, approximately half of which relates to diesel costs at our operations and in our transportation costs. Diesel prices have increased by 75% compared to the same period last year. The increases in the cost of certain key supplies, including mining equipment, fuel, tires and explosives, are being driven largely by price increases for underlying commodities such as steel, crude oil and natural gas. While our underlying key mining drivers remain relatively stable, inflationary pressures on diesel prices and other key input costs, as well as profit-based compensation and royalties continue to put upward pressure on our unit cost guidance through 2022.

-

Our usual guidance tables, including three-year production guidance, can be found on pages 31—35 of Teck’s full second quarter results for 2022 at the link below.

| 2022 Guidance – Summary | Previous | Change | Current |

|

Production Guidance |

|||

|

Copper (000's tonnes) |

273 - 290 | — | 273 - 290 |

|

Zinc (000's tonnes) |

630 - 665 | — | 630 - 665 |

|

Refined zinc (000's tonnes) |

270 - 285 | — | 270 - 285 |

|

Steelmaking coal (million tonnes) |

24.5 - 25.5 | (1.0) - (1.5) | 23.5 - 24.0 |

|

Bitumen (million barrels) |

12.0 - 14.4 | — | 12.0 - 14.4 |

|

Sales Guidance – Q3 2022 |

|||

|

Red Dog zinc in concentrate sales (000's tonnes) |

215 - 240 | ||

|

Steelmaking coal sales (million tonnes) |

5.8 - 6.2 | ||

|

Unit Cost Guidance |

|||

|

Copper net cash unit costs (US$/lb.)1 |

1.40 - 1.50 | 0.08 - 0.08 | 1.48 - 1.58 |

|

Zinc net cash unit costs (US$/lb.)1 |

0.32 - 0.38 | 0.05 - 0.05 | 0.37 - 0.43 |

|

Steelmaking coal adjusted site cash cost of sales (CAD$/tonne)1 |

79 - 83 | 8 - 9 | 87 - 92 |

|

Steelmaking coal transportation costs (CAD$/tonne)1 |

43 - 46 | - | 43 - 46 |

|

Bitumen adjusted operating costs (CAD$/barrel)1 |

28 - 32 | 5 - 4 | 33 - 36 |

Note:

1. This is a non-GAAP financial measure or ratio. See "Use of Non-GAAP Financial Measures and Ratios" for further information.

Click here to view Teck’s full second quarter results for 2022.

WEBCAST

Teck will host an Investor Conference Call to discuss its Q2/2022 financial results at 11:00 AM Eastern time, 8:00 AM Pacific time, on July 27, 2022. A live audio webcast of the conference call, together with supporting presentation slides, will be available at our website at www.teck.com. The webcast will be archived at www.teck.com.

Investor Contact:

Fraser Phillips

Senior Vice President, Investor Relations and Strategic Analysis

604.699.4621

fraser.phillips@teck.com

Media Contact:

Chris Stannell

Public Relations Manager

604.699.4368

chris.stannell@teck.com

USE OF NON-GAAP FINANCIAL MEASURES AND RATIOS

Our financial results are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. This document refers to a number of non-GAAP financial measures and non-GAAP ratios which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS or by Generally Accepted Accounting Principles (GAAP) in the United States.

The non-GAAP financial measures and non-GAAP ratios described below do not have standardized meanings under IFRS, may differ from those used by other issuers, and may not be comparable to similar financial measures and ratios reported by other issuers. These financial measures and ratios have been derived from our financial statements and applied on a consistent basis as appropriate. We disclose these financial measures and ratios because we believe they assist readers in understanding the results of our operations and financial position and provide further information about our financial results to investors. These measures should not be considered in isolation or used in substitute for other measures of performance prepared in accordance with IFRS.

Adjusted profit attributable to shareholders – For adjusted profit attributable to shareholders, we adjust profit attributable to shareholders as reported to remove the after-tax effect of certain types of transactions that reflect measurement changes on our balance sheet or are not indicative of our normal operating activities.

EBITDA – EBITDA is profit before net finance expense, provision for income taxes, and depreciation and amortization.

Adjusted EBITDA – Adjusted EBITDA is EBITDA before the pre-tax effect of the adjustments that we make to adjusted profit attributable to shareholders as described above.

Adjusted profit attributable to shareholders, EBITDA, and Adjusted EBITDA highlight items and allow us and readers to analyze the rest of our results more clearly. We believe that disclosing these measures assists readers in understanding the ongoing cash generating potential of our business in order to provide liquidity to fund working capital needs, service outstanding debt, fund future capital expenditures and investment opportunities, and pay dividends.

Gross profit before depreciation and amortization – Gross profit before depreciation and amortization is gross profit with depreciation and amortization expense added back. We believe this measure assists us and readers to assess our ability to generate cash flow from our business units or operations.

Adjusted site cash cost of sales – Adjusted site cash cost of sales for our steelmaking coal operations is defined as the cost of the product as it leaves the mine excluding depreciation and amortization charges, out-bound transportation costs and any one-time collective agreement charges and inventory write-down provisions.

Total cash unit costs – Total cash unit costs for our copper and zinc operations includes adjusted cash costs of sales, as described below, plus the smelter and refining charges added back in determining adjusted revenue. This presentation allows a comparison of total cash unit costs, including smelter charges, to the underlying price of copper or zinc in order to assess the margin for the mine on a per unit basis.

Net cash unit costs – Net cash unit costs of principal product, after deducting co-product and by-product margins, are also a common industry measure. By deducting the co- and by-product margin per unit of the principal product, the margin for the mine on a per unit basis may be presented in a single metric for comparison to other operations.

Adjusted cash cost of sales – Adjusted cash cost of sales for our copper and zinc operations is defined as the cost of the product delivered to the port of shipment, excluding depreciation and amortization charges, any one-time collective agreement charges or inventory write-down provisions and by-product cost of sales. It is common practice in the industry to exclude depreciation and amortization as these costs are non-cash and discounted cash flow valuation models used in the industry substitute expectations of future capital spending for these amounts.

Adjusted operating costs – Adjusted operating costs for our energy business unit is defined as the costs of product as it leaves the mine, excluding depreciation and amortization charges, cost of diluent for blending to transport our bitumen by pipeline, cost of non-proprietary product purchased and transportation costs of our product and non-proprietary product and any one-time collective agreement charges or inventory write-down provisions.

Adjusted basic earnings per share – Adjusted basic earnings per share is adjusted profit attributable to shareholders divided by average number of shares outstanding in the period.

Adjusted diluted earnings per share – Adjusted diluted earnings per share is adjusted profit attributable to shareholders divided by average number of fully diluted shares in a period.

Profit Attributable to Shareholders and Adjusted Profit Attributable to Shareholders

|

|

Three months ended June 30 |

Six months ended June 30 |

||||

|

(CAD$ in millions) |

2022 |

2021 |

2022 |

2021 |

||

|

Profit attributable to shareholders |

$1,675 |

$260 |

$3,246 |

$565 |

||

|

Add (deduct) on an after-tax basis: |

|

|

|

|

||

|

Loss on debt purchase |

46 |

- |

46 |

- |

||

|

QB2 variable consideration to IMSA and ENAMI |

37 |

13 |

96 |

43 |

||

|

Environmental costs |

(51) |

44 |

(111) |

11 |

||

|

Inventory write-downs (reversals) |

23 |

- |

23 |

(6) |

||

|

Share-based compensation |

6 |

24 |

88 |

34 |

||

|

Commodity derivatives |

34 |

(20) |

(3) |

(5) |

||

|

Other |

2 |

18 |

7 |

23 |

||

|

Adjusted profit attributable to shareholders |

$1,772 |

$339 |

$3,392 |

$665 |

||

|

Basic earnings per share |

$3.12 |

$0.49 |

$6.05 |

$1.06 |

||

|

Diluted earnings per share |

$3.07 |

$0.48 |

$5.94 |

$1.05 |

||

|

Adjusted basic earnings per share |

$3.30 |

$0.64 |

$6.33 |

$1.25 |

||

|

Adjusted diluted earnings per share |

$3.25 |

$0.63 |

$6.21 |

$1.23 |

||

Reconciliation of Basic Earnings per share to Adjusted Basic Earnings per share

|

|

Three months ended June 30 |

Six months ended June 30 |

||||

|

(Per share amounts) |

2022 |

2021 |

2022 |

2021 |

||

|

Basic earnings per share |

$3.12 |

$0.49 |

$6.05 |

$1.06 |

||

|

Add (deduct): |

|

|

|

|

||

|

Loss on debt purchase |

0.09 |

- |

0.09 |

- |

||

|

QB2 variable consideration to IMSA and ENAMI |

0.07 |

0.02 |

0.18 |

0.08 |

||

|

Environmental Costs |

(0.10) |

0.08 |

(0.21) |

(0.02) |

||

|

Inventory write-downs (reversals) |

0.04 |

- |

0.04 |

(0.01) |

||

|

Share-based compensation |

0.01 |

0.05 |

0.16 |

0.06 |

||

|

Commodity derivatives |

0.06 |

(0.04) |

(0.01) |

(0.01) |

||

|

Other |

0.01 |

0.04 |

0.03 |

0.05 |

||

|

Adjusted basic earnings per share |

$3.30 |

$0.64 |

$6.33 |

$1.25 |

||

Reconciliation of Diluted Earnings per share to Adjusted Diluted Earnings per share

|

|

Three months ended June 30 |

Six months ended June 30 |

||||

|

(Per share amounts) |

2022 |

2021 |

2022 |

2021 |

||

|

Diluted earnings per share |

$3.07 |

$0.48 |

$5.94 |

$1.05 |

||

|

Add (deduct): |

|

|

|

|

||

|

Loss on debt purchase |

0.08 |

- |

0.08 |

- |

||

|

QB2 variable consideration to IMSA and ENAMI |

0.07 |

0.03 |

0.18 |

0.08 |

||

|

Environmental costs |

(0.09) |

0.08 |

(0.20) |

0.02 |

||

|

Inventory write-downs (reversals) |

0.04 |

- |

0.04 |

(0.01) |

||

|

Share-based compensation |

0.01 |

0.04 |

0.16 |

0.06 |

||

|

Commodity derivatives |

0.06 |

(0.04) |

(0.01) |

(0.01) |

||

|

Other |

0.01 |

0.04 |

0.02 |

0.04 |

||

|

Adjusted diluted earnings per share |

$3.25 |

$0.63 |

$6.21 |

$1.23 |

||

Reconciliation of EBITDA and Adjusted EBITDA

|

|

Three months ended June 30 |

Six months ended June 30 |

||||

|

(CAD$ in millions) |

2022 |

2021 |

2022 |

2021 |

||

|

Profit before taxes |

$2,663 |

$469 |

$5,113 |

$970 |

||

|

Finance expense net of finance income |

46 |

51 |

95 |

102 |

||

|

Depreciation and amortization |

452 |

370 |

901 |

748 |

||

|

EBITDA |

3,161 |

890 |

6,109 |

1,820 |

||

|

Add (deduct): |

|

|

|

|

||

|

Loss of debt purchase |

63 |

- |

63 |

- |

||

|

QB2 variable consideration to IMSA and ENAMI |

62 |

21 |

161 |

71 |

||

|

Environmental Costs |

(71) |

61 |

(153) |

15 |

||

|

Inventory write-downs (reversals) |

32 |

- |

32 |

(10) |

||

|

Share-based compensation |

5 |

33 |

115 |

47 |

||

|

Commodity derivatives |

45 |

(27) |

(4) |

(7) |

||

|

Other |

(7) |

11 |

11 |

20 |

||

|

Adjusted EBITDA |

$3,290 |

$989 |

$6,334 |

$1,956 |

||

Reconciliation of Gross Profit Before Depreciation and Amortization

|

|

Three months ended June 30 |

Six months ended June 30 |

||||

|

(CAD$ in millions) |

2022 |

2021 |

2022 |

2021 |

||

|

Gross Profit |

$3,288 |

$689 |

$5,856 |

$1,343 |

||

|

Depreciation and amortization |

452 |

370 |

901 |

748 |

||

|

Gross profit before depreciation and amortization |

$3,740 |

$1,059 |

$6,757 |

$2,091 |

||

|

Reported as: |

|

|

|

|

||

|

Copper |

|

|

|

|

||

|

Highland Valley Copper |

$217 |

$194 |

$463 |

$396 |

||

|

Antamina |

298 |

254 |

556 |

456 |

||

|

Carmen de Andacollo |

37 |

59 |

76 |

106 |

||

|

Quebrada Blanca |

7 |

11 |

20 |

22 |

||

|

Other |

- |

- |

- |

- |

||

|

|

559 |

518 |

1,115 |

980 |

||

|

Zinc |

|

|

|

|

||

|

Trail Operations |

12 |

(3) |

46 |

40 |

||

|

Red Dog |

183 |

91 |

457 |

216 |

||

|

Other |

(1) |

8 |

(4) |

11 |

||

|

|

194 |

96 |

499 |

267 |

||

|

Steelmaking coal |

2,806 |

457 |

4,838 |

869 |

||

|

Energy |

181 |

(12) |

305 |

(25) |

||

|

Gross profit before depreciation and amortization |

$3,740 |

$1,059 |

$6,757 |

$2,091 |

||

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to as forward-looking statements). These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “should”, “believe” and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These statements speak only as of the date of this news release.

These forward-looking statements include, but are not limited to, statements concerning: our focus and strategy; anticipated global and regional supply, demand and market outlook for our commodities; the potential impact of the COVID-19 on our business and operations, including our ability to continue operations at our sites and progress our projects and strategy; our ability to manage challenges presented by COVID-19, including the effectiveness of our management protocols implemented to protect the health and safety of our employees; expectation of additional Class B subordinate voting share buybacks; our nature positive, carbon reduction and net-zero goals and expected actions and their effectiveness to achieve those goals; expectation that QB2 will be a long-life, low-cost operation with major expansion potential; QB2 capital cost guidance and estimate of QB2 COVID-19 related capital costs; size of estimated contingency for QB2; estimated timing of first production from QB2; expectation of increased molybdenum production in the third quarter of 2022 at Highland Valley Copper; expectation of higher copper production through the second half of 2022 at Quebrada Blanca; expectations regarding our QBME project, including the impact of the project and associated timing expectations; targeted timing of first production at San Nicolás; expectation that the high steelmaking coal price environment will continue to help offset cost pressures and drive high margins; expectation of improved plant performance in our steelmaking coal business unit in the second half of the year; timing of completion of the Fording River North SRF Phase II expansion and related capacity increases, and expectations for total water treatment capacity by the end of 2022; expected Elk Valley water related capital investment; expectation that our steelmaking coal business unit is well positioned to deliver strong financial performance in the third quarter; liquidity and availability of borrowings under our credit facilities; our expectations regarding our effective tax rate; and all guidance appearing in this document including but not limited to the production, sales, cost, unit cost, capital expenditure, cost reduction and other guidance under the heading “Guidance” and discussed in the various business unit sections.

These statements are based on a number of assumptions, including, but not limited to, assumptions regarding general business and economic conditions, interest rates, commodity and power prices, acts of foreign or domestic governments and the outcome of legal proceedings, the supply and demand for, deliveries of, and the level and volatility of prices of copper, coal, zinc and blended bitumen and our other metals and minerals, as well as oil, natural gas and other petroleum products, the timing of the receipt of regulatory and governmental approvals for our development projects and other operations, including mine extensions; positive results from the studies on our expansion and development projects; our ability to secure adequate transportation, including rail, pipeline and port services, for our products; our costs of production and our production and productivity levels, as well as those of our competitors; continuing availability of water and power resources for our operations; changes in credit market conditions and conditions in financial markets generally, the availability of funding to refinance our borrowings as they become due or to finance our development projects on reasonable terms; our ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; the availability of qualified employees and contractors for our operations, including our new developments and our ability to attract and retain skilled employees; the satisfactory negotiation of collective agreements with unionized employees; the impact of changes in Canadian-U.S. dollar and other foreign exchange rates on our costs and results; engineering and construction timetables and capital costs for our development and expansion projects; the benefits of technology for our operations and development projects, including the impact of our RACE21™ program; environmental compliance costs; market competition; the accuracy of our mineral reserve and resource estimates (including with respect to size, grade and recoverability) and the geological, operational and price assumptions on which these are based; tax benefits and tax rates; the outcome of our coal price and volume negotiations with customers; the outcome of our copper, zinc and lead concentrate treatment and refining charge negotiations with customers; the resolution of environmental and other proceedings or disputes; our ability to obtain, comply with and renew permits in a timely manner; and our ongoing relations with our employees and with our business and joint venture partners. Our Guidance tables include footnotes with further assumptions relating to our guidance and assumptions for certain other forward-looking statements accompany the statements in the document.

In addition, assumptions regarding the Elk Valley Water Quality Plan include assumptions that additional treatment will be effective at scale, and that the technology and facilities operate as expected, as well as additional assumptions discussed under the heading “Elk Valley Water Management Update”. Assumptions regarding QB2 include current project assumptions and assumptions regarding the final feasibility study, estimates of future construction capital at QB2 (including the range of COVID-19 capital costs) are based on a CLP/USD rate range of 900 to 975, as well as there being no unexpected material and negative impact to the various contractors, suppliers and subcontractors for the QB2 project relating to COVID-19 or otherwise that would impair their ability to provide goods and services as anticipated during the suspension period or ramp-up of construction activities. Statements regarding the availability of our credit facilities and project financing facility are based on assumptions that we will be able to satisfy the conditions for borrowing at the time of a borrowing request and that the facilities are not otherwise terminated or accelerated due to an event of default. Statements concerning future production costs or volumes are based on numerous assumptions regarding operating matters and on assumptions that counterparties perform their contractual obligations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labour disturbances, interruption in transportation or utilities, adverse weather conditions, and that there are no material unanticipated variations in the cost of energy or supplies and may be further impacted by reduced demand for oil and low oil prices. The foregoing list of assumptions is not exhaustive. Events or circumstances could cause actual results to vary materially.

Factors that may cause actual results to vary materially include, but are not limited to, changes in commodity and power prices, changes in market demand for our products, changes in interest and currency exchange rates, acts of governments and the outcome of legal proceedings, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, adverse weather conditions and unanticipated events related to health, safety and environmental matters), union labour disputes, impact of COVID-19 mitigation protocols, political risk, social unrest, failure of customers or counterparties (including logistics suppliers) to perform their contractual obligations, changes in our credit ratings, unanticipated increases in costs to construct our development projects, difficulty in obtaining permits, inability to address concerns regarding permits of environmental impact assessments, and changes or further deterioration in general economic conditions. Certain operations and projects are not controlled by us; schedules and costs may be adjusted by our partners, and timing of spending and operation of the operation or project is not in our control. Current and new technologies relating to our Elk Valley water treatment efforts may not perform as anticipated, and ongoing monitoring may reveal unexpected environmental conditions requiring additional remedial measures. QB2 costs, construction progress and timing of first production is dependent on, among other matters, our continued ability to successfully manage through the impacts of COVID-19. QB2 costs may also be affected by claims and other proceedings that might be brought against us relating to costs and impacts of the COVID-19 pandemic. Red Dog production may also be impacted by water levels at site. Unit costs in our copper business unit are impacted by higher profitability at Antamina, which can cause higher workers’ participation and royalty expenses. Sales to China may be impacted by general and specific port restrictions, Chinese regulation and policies and normal production and operating risks. Share buybacks depend on a number of additional factors that may cause actual results to vary, including, the ability to acquire Class B Shares in the market through the normal course issuer bid and in compliance with regulatory requirements, share price volatility, negative changes to commodity prices, availability of funds to purchase shares, alternative uses for funds. Share repurchases are also subject to conditions under corporate law.

The forward-looking statements in this news release and actual results will also be impacted by the effects of COVID-19 and related matters. The overall effects of COVID-19 related matters on our business and operations and projects will depend on how the ability of our sites to maintain normal operations, and on the duration of impacts on our suppliers, customers and markets for our products, all of which are unknown at this time. Continuing operating activities is highly dependent on the progression of the pandemic and the success of measures taken to prevent transmission, which will influence when health and government authorities remove various restrictions on business activities.

We assume no obligation to update forward-looking statements except as required under securities laws. Further information concerning risks and uncertainties associated with these forward-looking statements and our business can be found in our Annual Information Form for the year ended December 31, 2021, filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov) under cover of Form 40-F, as well as subsequent filings that can also be found under our profile.

Scientific and technical information in this quarterly report regarding our coal properties, which for this purpose does not include the discussion under “Elk Valley Water Management Update” was reviewed, approved and verified by Jo-Anna Singleton, P.Geo. and Robin Gold P.Eng., each an employee of Teck Coal Limited and a Qualified Person as defined under National Instrument 43-101. Scientific and technical information in this quarterly report regarding our other properties was reviewed, approved and verified by Rodrigo Alves Marinho, P.Geo., an employee of Teck and a Qualified Person as defined under National Instrument 43-101.

22-47-TR